Introducing F/m Compoundr™ ETFs — a smarter way to earn from fixed income, without the tax drag.

Traditional bond ETFs routinely distribute income that must be reinvested AFTER paying income taxes. Compoundr takes a different approach — staying 100% invested 100% of the time, to compound gains efficiently.

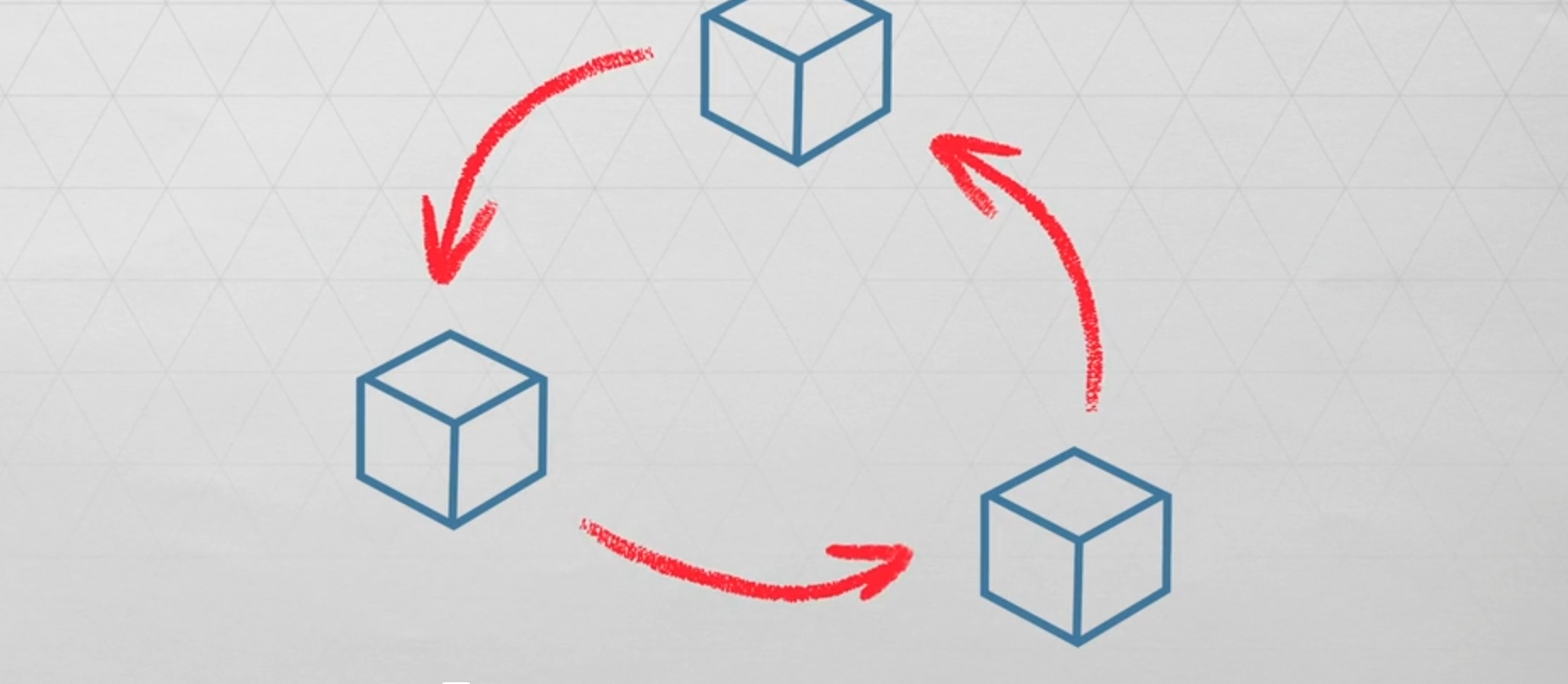

Each month, Compoundr rotates between similar ETFs, exiting before distributions are paid and re-entering afterward. This makes it possible to defer taxable income and stay fully invested to harness the power of compounding capital gains.

The result? A more efficient return structure — with the same market exposure. Best of all, investors can now control both the timing and the character of the income they earn from their fixed income investments.

Powered by Nasdaq’s index and substitution methodology, F/m Compoundr ETFs are built for high-net-worth investors, trust accounts, non-resident investors, and anyone seeking better control over tax timing and long-term performance.

F/m Compoundr: the return you earn is finally the return you keep.

Why invest in F/m Compoundr ETFs

- Avoid Taxable Distributions: Gives investors more control over the timing and the character of taxable income.

- Help Boost Total Return: Empowers investors to keep more of their assets invested continuously - to harness the power of compounding over time.

- 100% Reinvestment: Removes inefficiencies around reinvesting interest and dividends by keeping assets invested until a time of your choosing.

Learn More

- F/m Compoundr ETF Series Overview

- CPAG - F/m Compoundr U.S. Aggregate Bond ETF

- CPHY - F/m Compoundr High Yield ETF