Key Points

- Long-term inflation expectations are highest in the 21st century (3.9%). Near-term inflation expectations come in hot upside (4.9%).

- Inflation survey expectations surprise on the upside across the board.

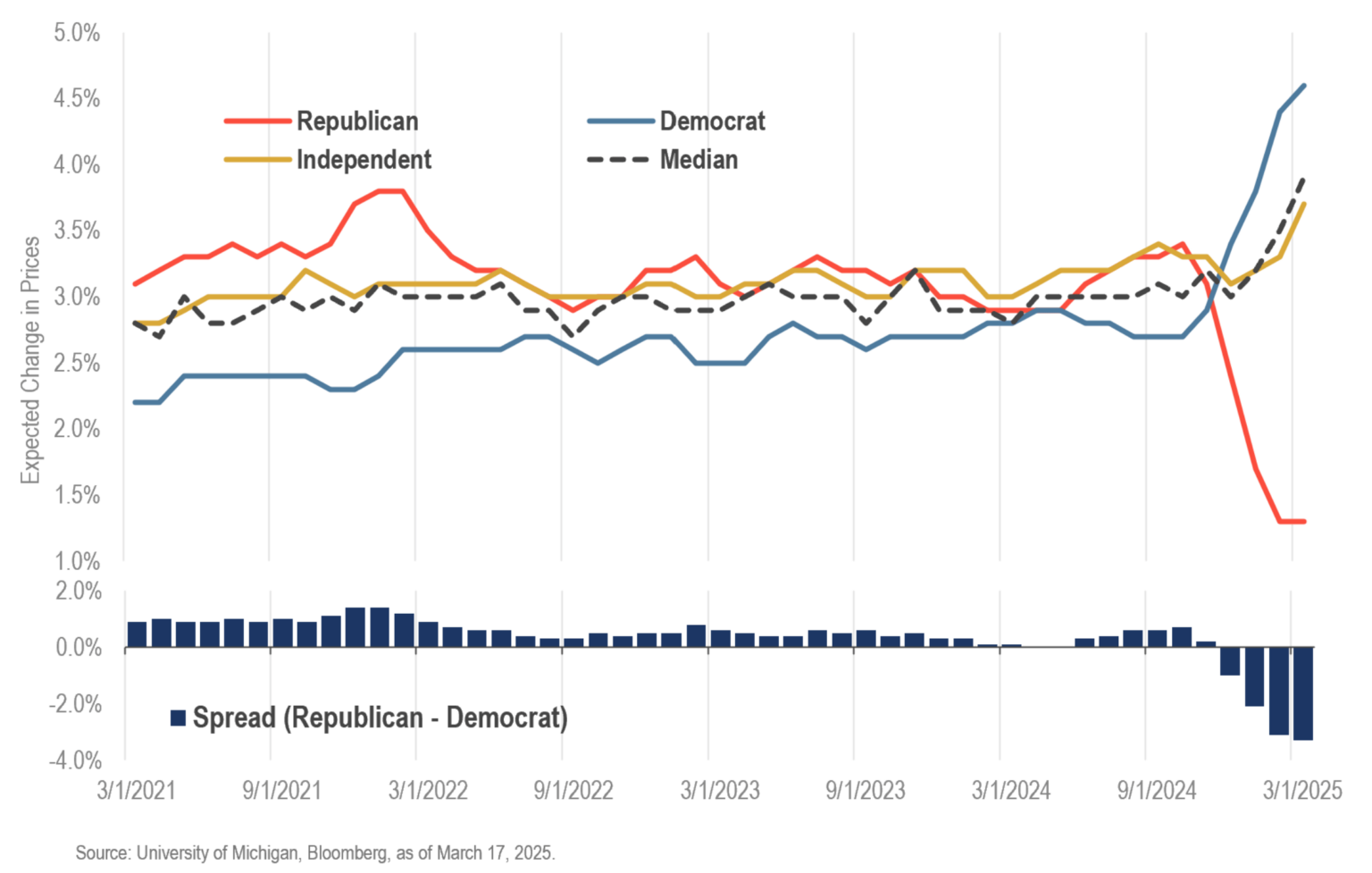

- The rift between Democrats (and independents) versus Republicans has grown to its highest since 2020.

- Ultrashort duration TIPS remains a possible antidote to inflation and policy fears. Now available in ETF form: RBIL.

Century High Inflation Fear

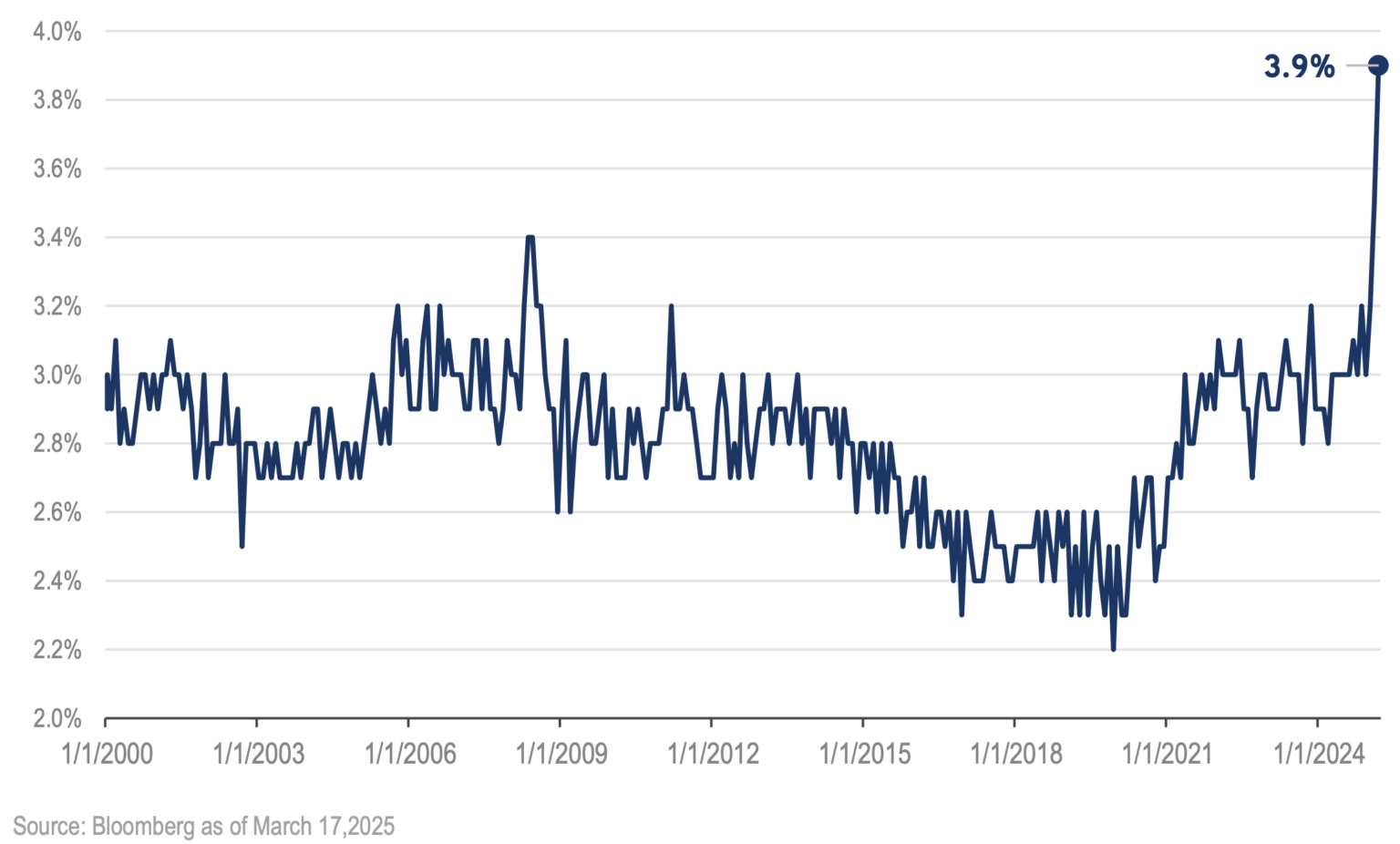

Consumers are now expecting 3.9% annualized price increases over the next 5-10 years. This is a 33% rise in expectations YTD. Combine this with a 4.9% headline rate (versus 4.3% consensus estimate) and deteriorating consumer sentiment measure, and one concept is crystal clear: inflation is a primary – perhaps the primary – concern for consumers.

University of Michigan U.S. 5-10 Year Inflation Expectations

Inflation Expectations Diverge by Political Affiliation

In a new twist, political party affiliation has become a leading indicator of economic expectations. Party cohorts have long differed on expected inflation levels in the past but generally agreed on the direction of inflation. Now there is a massive divergence reflects the wild swings in political policy, notably tariffs, tax cuts, and federal spending (portending stunted grow). Although Republican inflation fears declined sharply, independents shifted from a moderate to higher inflation outlook and Democrats’ fears increased further – suggesting most consumers are anxious about (really) inflation.

Expected Change in Prices During the Next Five Years By Political Affiliation

The Antidote to Inflation Fears

We believe investment in ultrashort TIPS remains the ideal solution to anxiety fears: participation in realized inflation with minimal interest rate risk. Now, more than ever, it is important to protect purchasing power. Investors can access this protection via RBIL – the industry’s first and only ultrashort TIPS ETF.